Think for yourself. How to use Peter Thiel’s notes to build the future

Do not reinvent the wheel. Copy with pride. What is the competition doing? Focus on fundamentals.

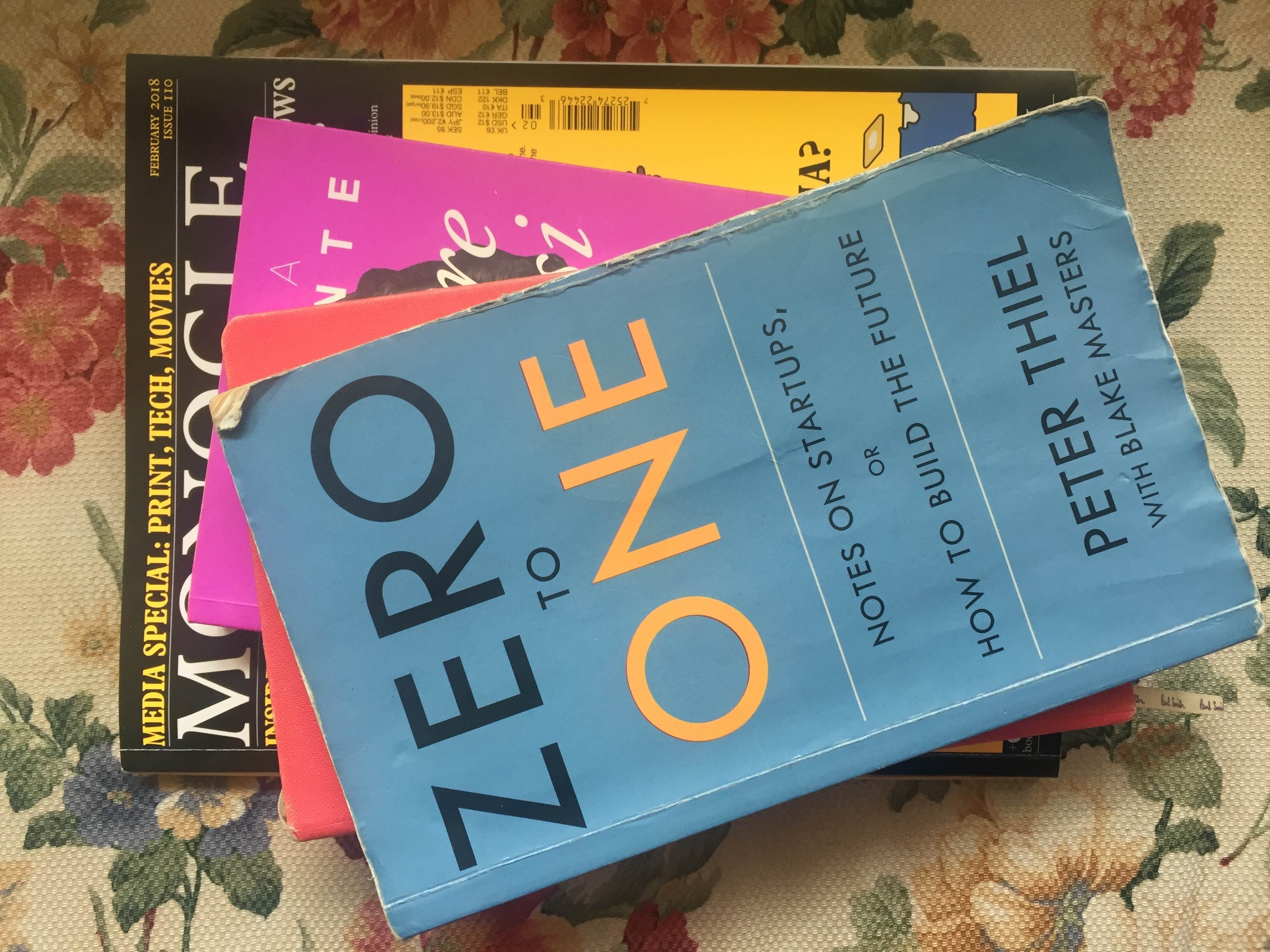

If any of these quotes sound familiar, you will peer at Peter Thiel’s book “Zero to One”. The co-founder of PayPal and Palantir does not like copying. While it may be easier to copy a model than to make something completely new, doing what we already know how to do takes the world from 1 to n, adding just familiarity. However, Thiel, a Standford Law School graduate pleads for taking the world from 0 to 1 from the get-go.

His book stemmed from a course about startups that he taught at Standford in 2012 and is not a manual about creating something completely new and thus going from 0 to 1. It is an exercise in thinking.

Why would you do that? Because:

- companies will fail in the future no matter how big the profits are today - competition decreases profits

- technology is miraculous as it allows us to do more with less

- you would love to work for or build companies that create new things

Zero to One has a co-author named Blake Masters, one of Thiel’s students who took detailed class notes that were later used to write the book. Do not get mislead by the subtitle, this is not a book just for startups. It is valid for all those who want to create something or who simply want to build a better future.

This is not an easy read, but more like an academic course. You need to take your own notes:) I took mine and I will share top 10 ideas to think of.

1. What important truth do very few people agree with you on? Ask this question in an interview. The good answers are as close as we can come to looking into the future. Peter Thiel believes in technology, while most people think that the future belongs to globalization. If every one of India’s hundreds of millions of households were to live the way Americand already do - using only today’s tools - the result would be environmentally catastrophic. In a world of scarce resources, globalization without new technology is unstaintable. A startup is the largest group of people that you can convince of a plan to build a different future.

There are two types of progress: horizontal, extensive (copying things that work) represented by globalization and vertical, intensive progress (doing new things) represented by technology.

2. What lessons we should learn from the dot.com crash?

“It’s hard to blame people for dancing when the music was playing”. This was the dot-com boom times, when attaching “.com” to your name could theoretically double your value overnight. But it was not sustainable. “Cause they say 2,000 zero zero party over, oops! Out of time! So tonight I’m gonna party like it’s 1999!” Prince

So, in order to avoid a similar party with similar or worse effects, take care to:

- make incremental advances - grand visions usually inflate the bubble

- stay lean (code for “unplanned”) and flexible

- improve on the competition (don’t create a new market prematurely)

- focus on product, not sales

3. What teaches Anna Karenina to the business world?

The business version of the interview question “What important truth do very few people agree with you on?” is “What valuable company is nobody building?". By 2012, a US airline brought in $160 billion and made 37 cents per passange. Google brought only $50 billion but made 100 times more profit margin. Meanwhile Google makes so much money that it’s now worth 3 times more than every US airline combined.

This is a perfect example of:

- “perfect competion” - undifferentiated, sells the same homogenous products. In the long run no company makes an economic profit

- “monopoly” - you own the market - by monopoly is meant the kind of company that’s good at what it does that no other firm can offer a close substitute

Is Google a monopoly? If we account it for a search engine, with 68% of the search market in 2014, the answer is yes. But if we account it for an advertising company, with 3.4% of the global advertising market, the answer is no. If taken as a multifaceted tech company, it owns only 0.24% of the consumer tech market. But Google never positions itself as a monopoly, cause monopolies minimizes their power.

In the same time, non-monopolists exaggerate their dominant position.

Anna Karenina, the famous Tolstoi character says: “All happy families are alike; each unhappy family is unhappy in its own way”. This is opposite to business: “All happy companies are different - each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.”

4. Why are we obsessed with the competition?

First it is the educational system that both drives and reflects our obsession with competition. Then it is the business comparisons to war - headhunters, captive market, make a killing, sales force. Competition is war, but war is costly business and Thiel makes an interesting parable to Microsoft and Google as Shakespeare’s Rome and Juliet.

Rivalry causes us to overemphasize old opportunities and obediently copy what has worked in the past. But this is usually leading to lower and lower margins. If you can’t beat a rival, it may be better to merge, the damages are much lower (he gives his own example with Elon Musk in 2000).

5. Have you thought of the last mover advantage in a market?

A great business is defined by its ability to generate cash fows in the future. The value of a business today is the sum of all the money it will make in the future. By example, in 2014, Linkedin had a market capitalization of $24.5 billion, a revenue of $1 billion and a net income of $21.6 million. The high valuation comes from an yes to the question: will this business still be around a decade from now? This is the question!

This is a quick checklist for a monopoly:

- proprietary technology - your product should be impossible to replicate. And the rule for it is to be 10 times better than its closest substitute (Amazon offered 10 times as many books as any other bookstore, it started as the Earth’s largest bookstore)

- network effects - a product is more useful as more people use it (ex Facebook), but it has to be valuable to its first small network of users (campus students)!

- economies of scale

- branding. However, do not begin with brand rather than substance, cause it is dangerous. No technology company (and we can extend to other company types) can be built on branding alone.

The best position is to be THE LAST mover into a particular market, meaning to make the last great development and enjoy years or even decades of monopoly profits.

6. How do you relate to future: definite/indefinite, pessimistic/optimistic?

Jeff Bezos declares that his success recipe is: “half luck, half good timing, and the rest brains”. Do you believe in luck or skill? And how do you relate to future? If you expect it to take a definite form, it makes sense to understand it in advance and work to shape it. If you are a pessimist like China - the future can be known, but it does not look very bright - you must prepare for it.

Thiel does not overrate the power of chance which was the case of generations like Gladwell’s, but stands for the power of planning. Prioritize design over chance - this is his advice!

7. Where to follow the money and the secrets?

The pervasive Pareto principle or the 80-20 rule can be described as the power law. This law applies also to venture capital funds. The best investment in a successful fund equals or outperforms the entire rest of the fund combined. This is happening because a small handful of companies radically outperform all others.

This law is important to everbody, not just the investors as each of us is an investor.

Everybody has been told: Don’t put all your eggs in one basket. But life is not a portfolio! An individual can not diversify his own life by keeping dozens of possible careers in ready reserve.

You should focus relentlessly on something you are good at doing, but before that you must think hard about whether it will be valuable in the future!

What’s most important is rarely obvious. Where can you find the secrets that will lead you to money? Conventional ideas are easy for everybody. Mysteries are impossible. But secrets are in between, hard to find, but not impossible.

Society tends to believe that there are no longer hard secrets left. Moreover, four social trends have conspired to root out belief in secrets:

- incrementalism - one step at a time, no big jumps

- risk aversion - the prospect of beinf lonely and wrong can be unbearable

- complacency

- flatness - globalization, homogenous world, highly competitive market place. If it were possible to discover something new, wouldn’t someone from the global talent pool of smarter and more creative people have found it already?

We should regain our sense of wonder at secrets left to be discovered. There are secrets about nature and secrets about people.

After a decade of inventions, HP stopped believing in secrets. They focused more on watching the processes than inventing. The outcome is well known. On the contrary, Andrew Wiles solved Fermat’s Last Theorem in 1995, after 10 years of working and more than 350 years since Fermat firstly stated it.

8. Foundations and company culture

A startup messed up at its foundation cannot be fixed. Choosing a co-founder is like choosing a spouse and a founder conflict is just as ugly as a divorce.

Also ownership, possesion and control need to be clarified: who legally owns the company, who actually runs it, who formally governs the company’s affairs? Everyone should be involved full time and people should be properly compensated. A company does better the less it pays the CEO - that’s one of the clearest patterns. For a startup, if a CEO expects to earn as much as he earned in a big corporation he will act like a politician, not like a founder. A cash poor executive will focus to increase the value of the company. And this is also setting the bar for everybody else.

But this can be compensated by part ownership of the company (that should be allocated carefully).

As for the company culture, this ca not be set with an interior decorator or an HR consultant or a branding specialist. Company culture doesn’t exist apart from the company itself: no company has a culture, every company is a culture.

When you want to hire the 20th employee for your company ask yourself a question: Why should the 20th employee join my company? For God’s sake, do not come with answers that everybody has at hand such as your stock options will be worth or you have the smartest people onboard or the most challenging problems to solve.

Your mission and your team should be the only two good answers for the 20th employee to join your company!

And as a manager, Thiels considers that the best he did at PayPal was to make every person in the company responsible for doing just one thing! Eliminate competition between your human resources!

9. How to promote your product

Thiel considers that sales should be hidden if they are good, comparing the selling to acting. The best job descriptions of sales people are hidden. Therefore, it is better to have business development written on your business card instead of sales director because none of us wants to be reminded when we are being sold.

The golden formula for an effective distribution of a product is: the total net profit that you earn on average over the course of your relationship with a customer (Customer Lifetime Value) must exceed the amount you spend on average to acquire a new customer (Customer Acquisition Cost).

There are 5 ways of promotion, depending on the value and the scalability of your product.

- complex sales: this is when the average sale is seven figures or more (eg SpaceX). Every detail of every deal requires close personal attention. It works best when you don’t have “salesmen”. In this case most probably a CEO would sell, but if he actually looks like a salesman, he’s probably bad at sales.

- personal sales: you need a process for a sales team who will move the product to a wide audience. Sometimes the product itself is a kind of distribution.

- distribution doldrums: in between personal sales and traditional advertising there is a dead zone. (ex software helping convenience store owners to track their inventory, priced at $1,000. This is limited offering at a low priced point that would make any kind of promotion inefficient.)

- marketing and advertising - works for relatively low-priced products that have mass appeal but lack any method of viral distribution. However, if you are small, resist the tempation to put the most memorable TV spots or PR stunts, cause they will not pay back.

- viral marketing - a product is viral if its core functionality encourages users to invite their friends to become users too. Whoever is first to dominate the most important segment of a market with viral potential will be the last mover in the whole market.

If you can get just one distribution channel to work, you have a great business: this is power law of ditribution.

Last, but not least important, your company needs to sell more than its product, it needs to sell itself to employees and investors.

10. Computers will neither eat your food, nor ask for a luxurious holiday

To the obsessive question if a machine will replace you, Thiel has an answer: computers are complements for humans, not substitues. The most valuable businesses of coming decades will be built by entrepreneurs who seek to empower people rather than try to make them obsolete.

People compete for jobs and for resources, while computers compete for neither. Whether people eat shark fins in Shangai or fish tacos in San Diego, they all need food and they all need a shelter. And desire doesn’t stop at subsistence - people will demand ever more as globalization continues. This is even more obvious at the top: “all oligarchs have the same taste in Cristal, from Petersburg to Pyongyang.”

Computers are different from people. We are good at forming plans and making decisions in complicated situation. We are less good at making sense of huge amount of data. Computers are the opposite. In 2012, one of Google’s supercomputers identified a cat with 75% accuracy after scanning 10 million thumbnails on Youtube videos. That might be impressive before you recall that a 4 year old can do it with 100% accuracy.

Computers don’t long for better food and expensive holidays, they require only a nominal amount of electricity.

So the obssesive question should be: How can computers help humans solve hard problems?

Conclusion:

The lesson for business is that we need founders. We should be more tolerant of founders who seem extreme or strange, we need unusual individuals to lead companies beyond mere incrementalism.

As for the founders, they should not oppose the crowd, but think for themselves! Ask yourself how much of what you know is shaped by mistaken reactions to past mistakes?